![]() How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

![]() If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

Hoe om te begin belê in die aandelemark

Hoe om te begin belê in die aandelemark Inhoudsopgawe:

Inhoudsopgawe:

Verstaan die basiese beginsels van aandelemarkbelegging

Verstaan die basiese beginsels van aandelemarkbelegging Die belangrikheid van die opstel van finansiële doelwitte

Die belangrikheid van die opstel van finansiële doelwitte Die keuse van die regte beleggingstrategie en voorbeelde

Die keuse van die regte beleggingstrategie en voorbeelde Hoe om te begin belê in die aandelemark

Hoe om te begin belê in die aandelemark Belangrike take

Belangrike take Algemene vrae

Algemene vrae

Verstaan die basiese beginsels van aandelemarkbelegging

Verstaan die basiese beginsels van aandelemarkbelegging

![]() How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like

How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like ![]() aftrede

aftrede![]() of onderwys. Dink daaraan as 'n tuin waar jou geld vinniger kan groei as wanneer jy dit in 'n gereelde spaarplek hou.

of onderwys. Dink daaraan as 'n tuin waar jou geld vinniger kan groei as wanneer jy dit in 'n gereelde spaarplek hou.

![]() Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

![]() Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you

Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you ![]() stel doelwitte

stel doelwitte![]() , decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

, decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

Die belangrikheid van die opstel van finansiële doelwitte

Die belangrikheid van die opstel van finansiële doelwitte

![]() Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Hoe om te begin belê in die aandelemark

Hoe om te begin belê in die aandelemark Definieer finansiële doelwitte

Definieer finansiële doelwitte

![]() At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to

At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to ![]() meet u vordering

meet u vordering![]() en sukses langs die pad.

en sukses langs die pad.

Verstaan risikotoleransie

Verstaan risikotoleransie

![]() Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

![]() Jonger beleggers het byvoorbeeld dikwels 'n hoër risikotoleransie omdat hulle meer tyd het om van markafswaai te herstel.

Jonger beleggers het byvoorbeeld dikwels 'n hoër risikotoleransie omdat hulle meer tyd het om van markafswaai te herstel.

Skep 'n balans vir sukses

Skep 'n balans vir sukses

![]() Terwyl jy jou beleggingsreis aanpak, is dit uiters belangrik om die regte balans tussen risiko en beloning te vind. Hoër-opbrengs beleggings kom tipies met verhoogde risiko, terwyl meer konserwatiewe opsies stabiliteit maar laer opbrengste bied.

Terwyl jy jou beleggingsreis aanpak, is dit uiters belangrik om die regte balans tussen risiko en beloning te vind. Hoër-opbrengs beleggings kom tipies met verhoogde risiko, terwyl meer konserwatiewe opsies stabiliteit maar laer opbrengste bied.

![]() Om die regte ewewig te vind in lyn met jou finansiële doelwitte en gemaksvlak is die sleutel tot die ontwikkeling van 'n suksesvolle en volhoubare beleggingstrategie. Om jou doelwitte te verstaan en te definieer, risikotoleransie te evalueer en die regte balans te vind is fundamentele komponente vir

Om die regte ewewig te vind in lyn met jou finansiële doelwitte en gemaksvlak is die sleutel tot die ontwikkeling van 'n suksesvolle en volhoubare beleggingstrategie. Om jou doelwitte te verstaan en te definieer, risikotoleransie te evalueer en die regte balans te vind is fundamentele komponente vir ![]() langtermyn sukses.

langtermyn sukses.

Die keuse van die regte beleggingstrategie en voorbeelde

Die keuse van die regte beleggingstrategie en voorbeelde

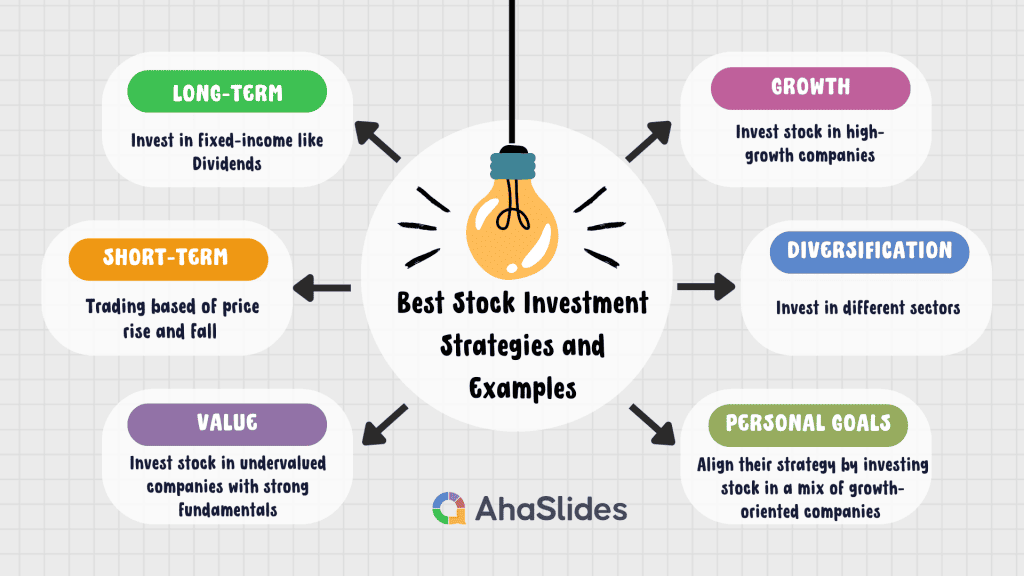

![]() Beleggingstrategieë is die bloudrukke wat jou besluite in die aandelemark rig. Hulle help om jou beleggings in lyn te bring met jou finansiële doelwitte en risikotoleransie.

Beleggingstrategieë is die bloudrukke wat jou besluite in die aandelemark rig. Hulle help om jou beleggings in lyn te bring met jou finansiële doelwitte en risikotoleransie.

![]() Deur hierdie werklike voorbeelde te verken, kan beleggers praktiese insigte kry oor hoe

Deur hierdie werklike voorbeelde te verken, kan beleggers praktiese insigte kry oor hoe ![]() verskillende strategieë

verskillende strategieë![]() toegepas kan word wanneer hulle besluit om voorraad in die dinamiese landskap van die aandelemark te belê.

toegepas kan word wanneer hulle besluit om voorraad in die dinamiese landskap van die aandelemark te belê.

Hoe om te begin belê in die aandelemark

Hoe om te begin belê in die aandelemark Langtermyn- vs. Korttermyn-strategieë

Langtermyn- vs. Korttermyn-strategieë

Langtermyn Strategie

Langtermyn Strategie : Oorweeg die strategie van individue wat kies om aandele in betroubare dividend-betalende maatskappye soos Johnson & Johnson te belê. Deur hierdie aandele vir 'n lang tydperk te hou, beoog beleggers om voordeel te trek uit beide kapitaalgroei en 'n bestendige inkomstestroom.

: Oorweeg die strategie van individue wat kies om aandele in betroubare dividend-betalende maatskappye soos Johnson & Johnson te belê. Deur hierdie aandele vir 'n lang tydperk te hou, beoog beleggers om voordeel te trek uit beide kapitaalgroei en 'n bestendige inkomstestroom. Korttermyn-strategie

Korttermyn-strategie : Aan die ander kant kies sommige beleggers om aandele aktief te belê in wisselvallige sektore soos

: Aan die ander kant kies sommige beleggers om aandele aktief te belê in wisselvallige sektore soos  tegnologie

tegnologie , kapitaliseer op korttermynmarkneigings. Byvoorbeeld, handel aandele van hoë-groei tegnologie maatskappye gebaseer op kwartaallikse

, kapitaliseer op korttermynmarkneigings. Byvoorbeeld, handel aandele van hoë-groei tegnologie maatskappye gebaseer op kwartaallikse  prestasie verslae.

prestasie verslae.

Waarde- en groeibelegging

Waarde- en groeibelegging

Waarde-belegging

Waarde-belegging : Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential.

: Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential. Groei Belegging

Groei Belegging : In teenstelling hiermee kan groeibeleggers kies om aandele in te belê

: In teenstelling hiermee kan groeibeleggers kies om aandele in te belê  hoë-groei maatskappye

hoë-groei maatskappye like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

diversifikasie

diversifikasie

![]() Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps

Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps ![]() risiko te verminder

risiko te verminder![]() , ensuring that the performance of one stock doesn't overly impact the entire portfolio.

, ensuring that the performance of one stock doesn't overly impact the entire portfolio.

Belyn strategie met persoonlike doelwitte

Belyn strategie met persoonlike doelwitte

![]() Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

Hoe om te begin belê in die aandelemark

Hoe om te begin belê in die aandelemark

![]() Hoe om te begin belê in die aandelemark vir beginners? Deur die keuse van 'n betroubare aandelemakelaar of beleggingsplatform met deurlopende monitering en aanpassingstrategieë te kombineer, skep jy 'n omvattende benadering tot belegging van aandele wat in lyn is met jou finansiële doelwitte en aanpasbaar is by veranderende marktoestande.

Hoe om te begin belê in die aandelemark vir beginners? Deur die keuse van 'n betroubare aandelemakelaar of beleggingsplatform met deurlopende monitering en aanpassingstrategieë te kombineer, skep jy 'n omvattende benadering tot belegging van aandele wat in lyn is met jou finansiële doelwitte en aanpasbaar is by veranderende marktoestande.

Hoe om te begin belê in die aandelemark

Hoe om te begin belê in die aandelemark  vir beginners

vir beginners Die keuse van 'n betroubare aandelemakelaar

Die keuse van 'n betroubare aandelemakelaar

![]() How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive

How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive ![]() opvoedkundige

opvoedkundige![]() hulpbronne. Voordat u 'n besluit neem, evalueer faktore soos transaksiekoste, rekeningfooie en die reeks beleggingsopsies wat aangebied word.

hulpbronne. Voordat u 'n besluit neem, evalueer faktore soos transaksiekoste, rekeningfooie en die reeks beleggingsopsies wat aangebied word.

Navorsing en keuse van aandele

Navorsing en keuse van aandele

![]() How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

Monitering van jou beleggingsportefeulje

Monitering van jou beleggingsportefeulje

![]() How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

Pas jou portefeulje aan soos nodig

Pas jou portefeulje aan soos nodig

![]() Hoe om in die aandelemark te begin belê Stap 4: Marktoestande en persoonlike omstandighede ontwikkel, wat periodieke aanpassings aan jou portefeulje vereis. As 'n aandeel onderpresteer of jou finansiële doelwitte verander, wees bereid om jou aandelebeleggings aan te pas. Oorweeg dit om jou portefeulje te herbalanseer of bates te hertoewys om te verseker dat dit ooreenstem met jou huidige doelwitte.

Hoe om in die aandelemark te begin belê Stap 4: Marktoestande en persoonlike omstandighede ontwikkel, wat periodieke aanpassings aan jou portefeulje vereis. As 'n aandeel onderpresteer of jou finansiële doelwitte verander, wees bereid om jou aandelebeleggings aan te pas. Oorweeg dit om jou portefeulje te herbalanseer of bates te hertoewys om te verseker dat dit ooreenstem met jou huidige doelwitte.

Belangrike take

Belangrike take

![]() In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

![]() 💡As jy op soek is na innoverende maniere om boeiende opleiding te lewer oor hoe om in die aandelemark te begin belê,

💡As jy op soek is na innoverende maniere om boeiende opleiding te lewer oor hoe om in die aandelemark te begin belê, ![]() AhaSlides

AhaSlides![]() is 'n goeie belegging. Hierdie

is 'n goeie belegging. Hierdie ![]() interaktiewe aanbiedingsinstrument

interaktiewe aanbiedingsinstrument![]() het alles wat jy nodig het om 'n gehoor met die eerste oogopslag te gryp en enige te maak

het alles wat jy nodig het om 'n gehoor met die eerste oogopslag te gryp en enige te maak ![]() werkswinkels

werkswinkels![]() en opleiding effektief.

en opleiding effektief.

Algemene vrae

Algemene vrae

![]() Hoe kan ek my reis in aandelemarkbelegging as 'n beginner begin?

Hoe kan ek my reis in aandelemarkbelegging as 'n beginner begin?

![]() Begin deur die grondbeginsels van aandele, effekte en beleggingstrategieë te leer deur beginnersvriendelike aanlynbronne en boeke. Definieer jou doelwitte, soos spaar vir 'n huis of aftrede, om jou beleggingsbesluite te rig. Verstaan jou gemaksvlak met markskommelings om jou beleggingsbenadering daarvolgens aan te pas.

Begin deur die grondbeginsels van aandele, effekte en beleggingstrategieë te leer deur beginnersvriendelike aanlynbronne en boeke. Definieer jou doelwitte, soos spaar vir 'n huis of aftrede, om jou beleggingsbesluite te rig. Verstaan jou gemaksvlak met markskommelings om jou beleggingsbenadering daarvolgens aan te pas.

![]() Begin met 'n bedrag wat ooreenstem met jou begroting en verhoog jou beleggings geleidelik oor tyd.

Begin met 'n bedrag wat ooreenstem met jou begroting en verhoog jou beleggings geleidelik oor tyd.

![]() Hoeveel geld is geskik vir 'n beginner om in die aandelemark te belê?

Hoeveel geld is geskik vir 'n beginner om in die aandelemark te belê?

![]() Begin met 'n bedrag wat vir jou gemaklik voel. Baie platforms maak voorsiening vir klein beleggings, so begin met 'n bedrag wat by jou finansiële vermoë pas. Die deurslaggewende aspek is om die beleggingsreis te begin, selfs al is die aanvanklike bedrag beskeie, en konsekwent oor tyd bydra.

Begin met 'n bedrag wat vir jou gemaklik voel. Baie platforms maak voorsiening vir klein beleggings, so begin met 'n bedrag wat by jou finansiële vermoë pas. Die deurslaggewende aspek is om die beleggingsreis te begin, selfs al is die aanvanklike bedrag beskeie, en konsekwent oor tyd bydra.

![]() Hoe begin ek 'n aandeel met $100?

Hoe begin ek 'n aandeel met $100?

![]() Om jou aandelemarkreis met $100 te begin, is haalbaar en wys. Leer jouself oor die basiese beginsels, stel duidelike doelwitte, en kies 'n lae fooi makelaars. Oorweeg fraksionele aandele en ETF's vir diversifikasie. Begin met bloukop-aandele en dra konsekwent by. Herbelê dividende vir groei, monitor jou beleggings en oefen geduld. Selfs met 'n beskeie som, lê hierdie gedissiplineerde benadering die grondslag vir langtermyn finansiële groei.

Om jou aandelemarkreis met $100 te begin, is haalbaar en wys. Leer jouself oor die basiese beginsels, stel duidelike doelwitte, en kies 'n lae fooi makelaars. Oorweeg fraksionele aandele en ETF's vir diversifikasie. Begin met bloukop-aandele en dra konsekwent by. Herbelê dividende vir groei, monitor jou beleggings en oefen geduld. Selfs met 'n beskeie som, lê hierdie gedissiplineerde benadering die grondslag vir langtermyn finansiële groei.

![]() Ref:

Ref: ![]() Forbes |

Forbes | ![]() Investopedia

Investopedia