![]() How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

![]() If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

Kif Tibda Tinvesti fil-Borża

Kif Tibda Tinvesti fil-Borża Werrej:

Werrej:

Nifhmu l-Bażi tal-Investiment tas-Suq Stock

Nifhmu l-Bażi tal-Investiment tas-Suq Stock L-Importanza li Twaqqaf Għanijiet Finanzjarji

L-Importanza li Twaqqaf Għanijiet Finanzjarji Għażla tal-Istrateġija ta' Investiment it-Tajba u Eżempji

Għażla tal-Istrateġija ta' Investiment it-Tajba u Eżempji Kif Tibda Tinvesti fil-Borża

Kif Tibda Tinvesti fil-Borża Teħid ta 'Ħlas Ewlenin

Teħid ta 'Ħlas Ewlenin Mistoqsijiet Frekwenti

Mistoqsijiet Frekwenti

Nifhmu l-Bażi tal-Investiment tas-Suq Stock

Nifhmu l-Bażi tal-Investiment tas-Suq Stock

![]() How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like

How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like ![]() irtirar

irtirar![]() jew edukazzjoni. Aħseb fih bħala ġnien fejn flusek jistgħu jikbru aktar malajr milli kieku żżommu f'post ta' tfaddil regolari.

jew edukazzjoni. Aħseb fih bħala ġnien fejn flusek jistgħu jikbru aktar malajr milli kieku żżommu f'post ta' tfaddil regolari.

![]() Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

![]() Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you

Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you ![]() issettja miri

issettja miri![]() , decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

, decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

L-Importanza li Twaqqaf Għanijiet Finanzjarji

L-Importanza li Twaqqaf Għanijiet Finanzjarji

![]() Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Kif Tibda Tinvesti fil-Borża

Kif Tibda Tinvesti fil-Borża Id-Definizzjoni tal-Għanijiet Finanzjarji

Id-Definizzjoni tal-Għanijiet Finanzjarji

![]() At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to

At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to ![]() kejjel il-progress tiegħek

kejjel il-progress tiegħek![]() u suċċess tul it-triq.

u suċċess tul it-triq.

Ifhem it-Tolleranza tar-Riskju

Ifhem it-Tolleranza tar-Riskju

![]() Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

![]() Pereżempju, investituri iżgħar spiss ikollhom tolleranza għar-riskju ogħla minħabba li jkollhom aktar ħin biex jirkupraw mit-tnaqqis fir-ritmu tas-suq.

Pereżempju, investituri iżgħar spiss ikollhom tolleranza għar-riskju ogħla minħabba li jkollhom aktar ħin biex jirkupraw mit-tnaqqis fir-ritmu tas-suq.

Jolqot Bilanċ għas-Suċċess

Jolqot Bilanċ għas-Suċċess

![]() Hekk kif tibda l-vjaġġ ta’ investiment tiegħek, li ssib il-bilanċ it-tajjeb bejn ir-riskju u l-premju huwa importanti ħafna. Investimenti b'rendiment ogħla tipikament jiġu b'riskju akbar, filwaqt li għażliet aktar konservattivi joffru stabbiltà iżda qligħ aktar baxx.

Hekk kif tibda l-vjaġġ ta’ investiment tiegħek, li ssib il-bilanċ it-tajjeb bejn ir-riskju u l-premju huwa importanti ħafna. Investimenti b'rendiment ogħla tipikament jiġu b'riskju akbar, filwaqt li għażliet aktar konservattivi joffru stabbiltà iżda qligħ aktar baxx.

![]() Is-sejba tal-ekwilibriju t-tajjeb allinjat mal-miri finanzjarji tiegħek u l-livell ta' kumdità hija essenzjali biex tiżviluppa strateġija ta' investiment ta' suċċess u sostenibbli. Il-fehim u d-definizzjoni tal-miri tiegħek, il-valutazzjoni tat-tolleranza tar-riskju, u l-ilħuq tal-bilanċ it-tajjeb huma komponenti fundamentali għalihom

Is-sejba tal-ekwilibriju t-tajjeb allinjat mal-miri finanzjarji tiegħek u l-livell ta' kumdità hija essenzjali biex tiżviluppa strateġija ta' investiment ta' suċċess u sostenibbli. Il-fehim u d-definizzjoni tal-miri tiegħek, il-valutazzjoni tat-tolleranza tar-riskju, u l-ilħuq tal-bilanċ it-tajjeb huma komponenti fundamentali għalihom ![]() suċċess fit-tul.

suċċess fit-tul.

Għażla tal-Istrateġija ta' Investiment it-Tajba u Eżempji

Għażla tal-Istrateġija ta' Investiment it-Tajba u Eżempji

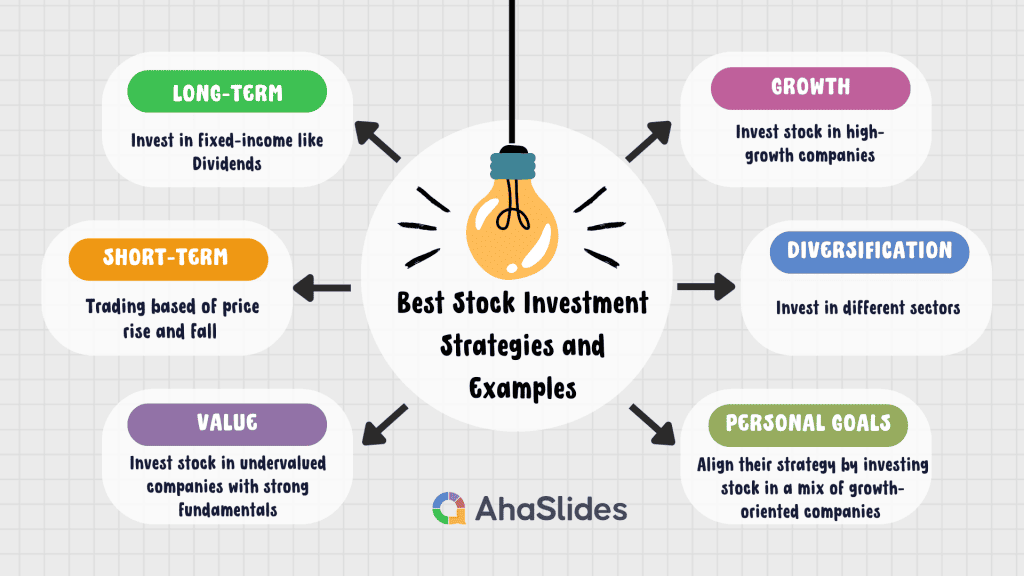

![]() L-istrateġiji ta' investiment huma l-pjani li jiggwidaw id-deċiżjonijiet tiegħek fl-istokk tas-suq. Jgħinu biex jallinjaw l-investimenti tiegħek mal-miri finanzjarji tiegħek u t-tolleranza tar-riskju.

L-istrateġiji ta' investiment huma l-pjani li jiggwidaw id-deċiżjonijiet tiegħek fl-istokk tas-suq. Jgħinu biex jallinjaw l-investimenti tiegħek mal-miri finanzjarji tiegħek u t-tolleranza tar-riskju.

![]() Billi jesploraw dawn l-eżempji fid-dinja reali, l-investituri jistgħu jiksbu għarfien prattiku dwar kif

Billi jesploraw dawn l-eżempji fid-dinja reali, l-investituri jistgħu jiksbu għarfien prattiku dwar kif ![]() strateġiji differenti

strateġiji differenti![]() jistgħu jiġu applikati meta jiddeċiedu li jinvestu l-istokk fil-pajsaġġ dinamiku tal-istokk tas-suq.

jistgħu jiġu applikati meta jiddeċiedu li jinvestu l-istokk fil-pajsaġġ dinamiku tal-istokk tas-suq.

Kif Tibda Tinvesti fil-Borża

Kif Tibda Tinvesti fil-Borża Strateġiji fit-Tul vs

Strateġiji fit-Tul vs

Strateġija fit-Tul

Strateġija fit-Tul : Ikkunsidra l-istrateġija ta’ individwi li jagħżlu li jinvestu stock f’kumpaniji affidabbli li jħallsu d-dividendi bħal Johnson & Johnson. Billi jżommu fuq dawn l-istokks għal perjodu estiż, l-investituri jimmiraw li jibbenefikaw kemm minn apprezzament tal-kapital kif ukoll minn fluss ta’ dħul kostanti.

: Ikkunsidra l-istrateġija ta’ individwi li jagħżlu li jinvestu stock f’kumpaniji affidabbli li jħallsu d-dividendi bħal Johnson & Johnson. Billi jżommu fuq dawn l-istokks għal perjodu estiż, l-investituri jimmiraw li jibbenefikaw kemm minn apprezzament tal-kapital kif ukoll minn fluss ta’ dħul kostanti. Strateġija għal żmien qasir

Strateġija għal żmien qasir : Min-naħa l-oħra, xi investituri jagħżlu li jinvestu b'mod attiv l-istokk f'setturi volatili bħal

: Min-naħa l-oħra, xi investituri jagħżlu li jinvestu b'mod attiv l-istokk f'setturi volatili bħal  teknoloġija

teknoloġija , li tikkapitalizza fuq ix-xejriet tas-suq għal żmien qasir. Pereżempju, jinnegozjaw ishma ta 'kumpaniji tat-teknoloġija bi tkabbir għoli bbażati fuq kull tliet xhur

, li tikkapitalizza fuq ix-xejriet tas-suq għal żmien qasir. Pereżempju, jinnegozjaw ishma ta 'kumpaniji tat-teknoloġija bi tkabbir għoli bbażati fuq kull tliet xhur  rapporti tal-prestazzjoni.

rapporti tal-prestazzjoni.

Investiment ta' Valur u Tkabbir

Investiment ta' Valur u Tkabbir

Valur tal-Investiment

Valur tal-Investiment : Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential.

: Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential. Investiment fit-Tkabbir

Investiment fit-Tkabbir : B'kuntrast, l-investituri tat-tkabbir jistgħu jagħżlu li jinvestu l-istokk fihom

: B'kuntrast, l-investituri tat-tkabbir jistgħu jagħżlu li jinvestu l-istokk fihom  kumpaniji bi tkabbir għoli

kumpaniji bi tkabbir għoli like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

diversifikazzjoni

diversifikazzjoni

![]() Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps

Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps ![]() itaffi r-riskju

itaffi r-riskju![]() , ensuring that the performance of one stock doesn't overly impact the entire portfolio.

, ensuring that the performance of one stock doesn't overly impact the entire portfolio.

Allinjament tal-Istrateġija mal-Għanijiet Personali

Allinjament tal-Istrateġija mal-Għanijiet Personali

![]() Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

Kif Tibda Tinvesti fil-Borża

Kif Tibda Tinvesti fil-Borża

![]() Kif tibda tinvesti fl-istokk tas-suq għal dawk li jibdew? Billi tgħaqqad l-għażla ta’ sensar tal-istokks affidabbli jew pjattaforma ta’ investiment ma’ strateġiji ta’ monitoraġġ u aġġustament kontinwu, inti toħloq approċċ komprensiv għall-investiment tal-istokks li jkun allinjat mal-miri finanzjarji tiegħek u adattabbli għall-kundizzjonijiet tas-suq li jinbidlu.

Kif tibda tinvesti fl-istokk tas-suq għal dawk li jibdew? Billi tgħaqqad l-għażla ta’ sensar tal-istokks affidabbli jew pjattaforma ta’ investiment ma’ strateġiji ta’ monitoraġġ u aġġustament kontinwu, inti toħloq approċċ komprensiv għall-investiment tal-istokks li jkun allinjat mal-miri finanzjarji tiegħek u adattabbli għall-kundizzjonijiet tas-suq li jinbidlu.

Kif Tibda Tinvesti fil-Borża

Kif Tibda Tinvesti fil-Borża  għall-Beginners

għall-Beginners Għażla ta' Broker ta' Stokk Affidabbli

Għażla ta' Broker ta' Stokk Affidabbli

![]() How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive

How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive ![]() edukattivi

edukattivi![]() riżorsi. Qabel ma tieħu deċiżjoni, evalwa fatturi bħall-ispejjeż tat-tranżazzjonijiet, it-tariffi tal-kont, u l-firxa ta 'għażliet ta' investiment offruti.

riżorsi. Qabel ma tieħu deċiżjoni, evalwa fatturi bħall-ispejjeż tat-tranżazzjonijiet, it-tariffi tal-kont, u l-firxa ta 'għażliet ta' investiment offruti.

Ir-riċerka u l-għażla tal-istokks

Ir-riċerka u l-għażla tal-istokks

![]() How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

Monitoraġġ tal-Portafoll tal-Investiment Tiegħek

Monitoraġġ tal-Portafoll tal-Investiment Tiegħek

![]() How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

Aġġusta l-portafoll tiegħek kif meħtieġ

Aġġusta l-portafoll tiegħek kif meħtieġ

![]() Kif Tibda Tinvesti fis-Suq Borża Pass 4: Il-kundizzjonijiet tas-suq u ċ-ċirkostanzi personali jevolvu, u jeħtieġu aġġustamenti perjodiċi fil-portafoll tiegħek. Jekk stokk ma jkollux prestazzjoni baxxa jew l-għanijiet finanzjarji tiegħek jinbidlu, kun lest li taġġusta l-investimenti tal-istokk tiegħek. Ikkunsidra li tibbilanċja mill-ġdid il-portafoll tiegħek jew tirrialloka l-assi biex tiżgura li jallinjaw mal-objettivi attwali tiegħek.

Kif Tibda Tinvesti fis-Suq Borża Pass 4: Il-kundizzjonijiet tas-suq u ċ-ċirkostanzi personali jevolvu, u jeħtieġu aġġustamenti perjodiċi fil-portafoll tiegħek. Jekk stokk ma jkollux prestazzjoni baxxa jew l-għanijiet finanzjarji tiegħek jinbidlu, kun lest li taġġusta l-investimenti tal-istokk tiegħek. Ikkunsidra li tibbilanċja mill-ġdid il-portafoll tiegħek jew tirrialloka l-assi biex tiżgura li jallinjaw mal-objettivi attwali tiegħek.

Teħid ta 'Ħlas Ewlenin

Teħid ta 'Ħlas Ewlenin

![]() In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

![]() 💡Jekk qed tfittex modi innovattivi biex tagħti taħriġ konvinċenti dwar kif tibda tinvesti fl-istokk tas-suq,

💡Jekk qed tfittex modi innovattivi biex tagħti taħriġ konvinċenti dwar kif tibda tinvesti fl-istokk tas-suq, ![]() AhaSlides

AhaSlides![]() huwa investiment kbir. Dan

huwa investiment kbir. Dan ![]() għodda ta' preżentazzjoni interattiva

għodda ta' preżentazzjoni interattiva![]() għandu dak kollu li għandek bżonn biex taqbad udjenza mal-ewwel daqqa t'għajn u tagħmel kwalunkwe

għandu dak kollu li għandek bżonn biex taqbad udjenza mal-ewwel daqqa t'għajn u tagħmel kwalunkwe ![]() workshops

workshops![]() u taħriġ effettiv.

u taħriġ effettiv.

Mistoqsijiet Frekwenti

Mistoqsijiet Frekwenti

![]() Kif nista' nibda l-vjaġġ tiegħi fl-investiment fil-Borża bħala Bidu?

Kif nista' nibda l-vjaġġ tiegħi fl-investiment fil-Borża bħala Bidu?

![]() Ibda billi titgħallem il-prinċipji fundamentali tal-istokks, il-bonds, u l-istrateġiji ta 'investiment permezz ta' riżorsi u kotba onlajn faċli biex jibdew. Iddefinixxi l-għanijiet tiegħek, bħal tfaddil għal dar jew irtirar, biex tiggwida d-deċiżjonijiet ta 'investiment tiegħek. Ifhem il-livell ta' kumdità tiegħek mal-varjazzjonijiet tas-suq biex tfassal l-approċċ tal-investiment tiegħek kif xieraq.

Ibda billi titgħallem il-prinċipji fundamentali tal-istokks, il-bonds, u l-istrateġiji ta 'investiment permezz ta' riżorsi u kotba onlajn faċli biex jibdew. Iddefinixxi l-għanijiet tiegħek, bħal tfaddil għal dar jew irtirar, biex tiggwida d-deċiżjonijiet ta 'investiment tiegħek. Ifhem il-livell ta' kumdità tiegħek mal-varjazzjonijiet tas-suq biex tfassal l-approċċ tal-investiment tiegħek kif xieraq.

![]() Ibda b'ammont li jallinja mal-baġit tiegħek u gradwalment iżżid l-investimenti tiegħek maż-żmien.

Ibda b'ammont li jallinja mal-baġit tiegħek u gradwalment iżżid l-investimenti tiegħek maż-żmien.

![]() Kemm flus huma adattati għal Bidu biex jinvesti fl-istokk tas-suq?

Kemm flus huma adattati għal Bidu biex jinvesti fl-istokk tas-suq?

![]() Ibda b'ammont li jħossu komdu għalik. Ħafna pjattaformi jippermettu investimenti żgħar, għalhekk ibda b'ammont li jaqbel mal-kapaċità finanzjarja tiegħek. L-aspett kruċjali huwa li jibda l-vjaġġ ta’ investiment, anki jekk is-somma inizjali hija modesta, u tikkontribwixxi b’mod konsistenti maż-żmien.

Ibda b'ammont li jħossu komdu għalik. Ħafna pjattaformi jippermettu investimenti żgħar, għalhekk ibda b'ammont li jaqbel mal-kapaċità finanzjarja tiegħek. L-aspett kruċjali huwa li jibda l-vjaġġ ta’ investiment, anki jekk is-somma inizjali hija modesta, u tikkontribwixxi b’mod konsistenti maż-żmien.

![]() Kif nista' nibda stokk b'$100?

Kif nista' nibda stokk b'$100?

![]() Li tibda l-vjaġġ tiegħek fl-istokk tas-suq b'$ 100 huwa fattibbli u għaqli. Teduka lilek innifsek fuq l-affarijiet bażiċi, waqqaf miri ċari, u agħżel senserija bi ħlas baxx. Ikkunsidra ishma frazzjonali u ETFs għad-diversifikazzjoni. Ibda bl-istokks blue-chip u tikkontribwixxi b'mod konsistenti. Investi mill-ġdid id-dividendi għat-tkabbir, immonitorja l-investimenti tiegħek, u pprattika l-paċenzja. Anke b'somma modesta, dan l-approċċ dixxiplinat jistabbilixxi l-pedament għal tkabbir finanzjarju fit-tul.

Li tibda l-vjaġġ tiegħek fl-istokk tas-suq b'$ 100 huwa fattibbli u għaqli. Teduka lilek innifsek fuq l-affarijiet bażiċi, waqqaf miri ċari, u agħżel senserija bi ħlas baxx. Ikkunsidra ishma frazzjonali u ETFs għad-diversifikazzjoni. Ibda bl-istokks blue-chip u tikkontribwixxi b'mod konsistenti. Investi mill-ġdid id-dividendi għat-tkabbir, immonitorja l-investimenti tiegħek, u pprattika l-paċenzja. Anke b'somma modesta, dan l-approċċ dixxiplinat jistabbilixxi l-pedament għal tkabbir finanzjarju fit-tul.

![]() Ref:

Ref: ![]() Forbes |

Forbes | ![]() Investopedia

Investopedia