![]() Kumaha Mimitian Investasi

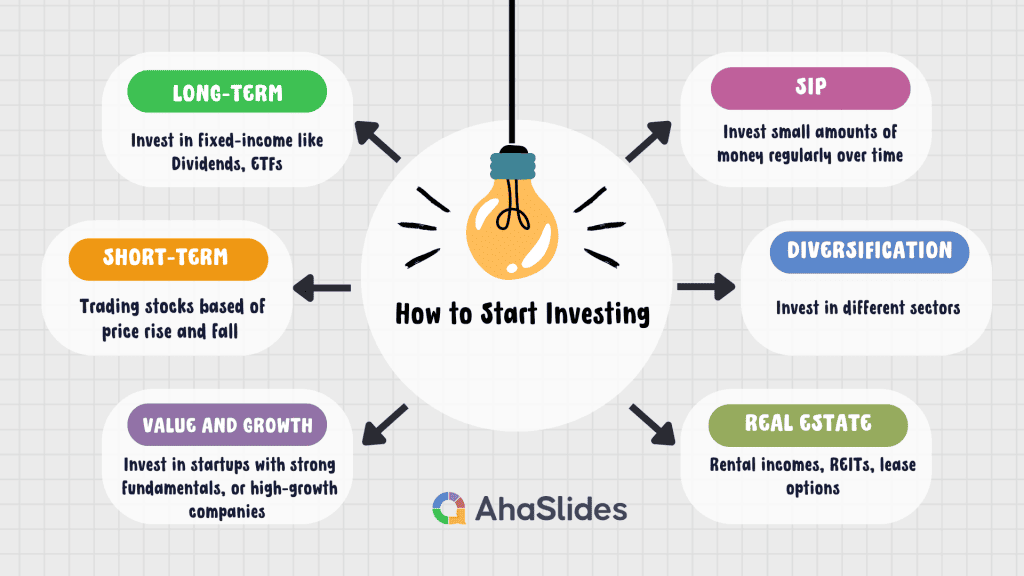

Kumaha Mimitian Investasi![]() ? Millionaires and billionaires rarely — maybe NEVER — leave money “lying around” as cash. Investing is one of the most effective ways to make the most of your money. So how to start investing, or how to start investing without money? Should I invest in real estate? Let's find answers to your questions about investing now.

? Millionaires and billionaires rarely — maybe NEVER — leave money “lying around” as cash. Investing is one of the most effective ways to make the most of your money. So how to start investing, or how to start investing without money? Should I invest in real estate? Let's find answers to your questions about investing now.

![]() Dina artikel ieu, anjeun bakal diajar:

Dina artikel ieu, anjeun bakal diajar:

Kumaha ngamimitian investasi salaku rumaja?

Kumaha ngamimitian investasi salaku rumaja? Sakumaha seueur artos anu anjeun peryogikeun pikeun ngamimitian investasi?

Sakumaha seueur artos anu anjeun peryogikeun pikeun ngamimitian investasi? Kumaha Mimitian Usaha Tanpa Duit?

Kumaha Mimitian Usaha Tanpa Duit? Kumaha Mimitian Investasi di Pasar Saham?

Kumaha Mimitian Investasi di Pasar Saham? Kumaha Mimitian Investasi dina Perumahan?

Kumaha Mimitian Investasi dina Perumahan? Kumaha Mimitian Investasi di SIP?

Kumaha Mimitian Investasi di SIP? Kumaha Mimitian Investasi di Startups?

Kumaha Mimitian Investasi di Startups? Takeaways Key

Takeaways Key Patarosan remen tanya

Patarosan remen tanya

Kumaha ngamimitian investasi di 2024

Kumaha ngamimitian investasi di 2024 Tips ti AhaSlides

Tips ti AhaSlides

Maksimalkeun Usaha anjeun Sareng Strategi Pemasaran Google | 8 Léngkah Praktis Pikeun Kiwari

Maksimalkeun Usaha anjeun Sareng Strategi Pemasaran Google | 8 Léngkah Praktis Pikeun Kiwari Jaringan Usaha | The Ultimate Guide kalawan 10+ Tips éféktif

Jaringan Usaha | The Ultimate Guide kalawan 10+ Tips éféktif 15 Conto Strategi Pemasaran Anu Ngadorong Kasuksesan Usaha

15 Conto Strategi Pemasaran Anu Ngadorong Kasuksesan Usaha

Meunangkeun Pamirsa Anjeun Kalibet

Meunangkeun Pamirsa Anjeun Kalibet

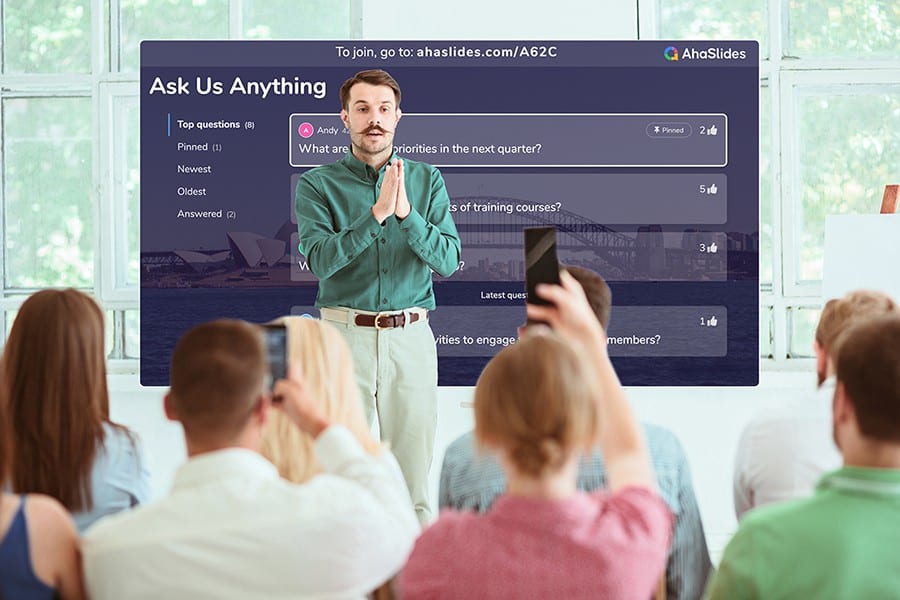

![]() Mimitian diskusi anu bermakna, kéngingkeun tanggapan anu mangpaat sareng ngadidik pamiarsa anjeun. Ngadaptar pikeun nyandak template AhaSlides gratis

Mimitian diskusi anu bermakna, kéngingkeun tanggapan anu mangpaat sareng ngadidik pamiarsa anjeun. Ngadaptar pikeun nyandak template AhaSlides gratis

Kumaha Mimitian Investasi salaku Rumaja?

Kumaha Mimitian Investasi salaku Rumaja?

![]() Kalayan popularitas internét sareng paningkatan balanja online sareng investasi, rumaja nampi artos langkung seueur tibatan kolotna dina umur anu sami ayeuna. Malah sateuacan era digital ieu,

Kalayan popularitas internét sareng paningkatan balanja online sareng investasi, rumaja nampi artos langkung seueur tibatan kolotna dina umur anu sami ayeuna. Malah sateuacan era digital ieu, ![]() ngamimitian investasi nalika anjeun ngan ukur umur 13

ngamimitian investasi nalika anjeun ngan ukur umur 13![]() or 14 isn't so out of limit, and Warren Buffett is an excellent example. Not all of us can have a sharp mind like Warren Buffet when we are just a teenager, but there is huge potential to start investing now.

or 14 isn't so out of limit, and Warren Buffett is an excellent example. Not all of us can have a sharp mind like Warren Buffet when we are just a teenager, but there is huge potential to start investing now.

![]() Simple as that, open a brokerage account from trusted platforms, buy stock, bonds, dividends, and focus on long-term growth. After 5-6 years, you'll be surprised that you have earned more than what you expected.

Simple as that, open a brokerage account from trusted platforms, buy stock, bonds, dividends, and focus on long-term growth. After 5-6 years, you'll be surprised that you have earned more than what you expected.

Sakumaha seueur artos anu anjeun peryogikeun pikeun ngamimitian investasi?

Sakumaha seueur artos anu anjeun peryogikeun pikeun ngamimitian investasi?

![]() Ayeuna, anjeun tiasa heran

Ayeuna, anjeun tiasa heran ![]() sabaraha duit pikeun ngamimitian investasi

sabaraha duit pikeun ngamimitian investasi![]() ? There is no specific answer for that, of course if you have a lot of money, it doesn't matter. For people with average income, a good rule of thumb is taking

? There is no specific answer for that, of course if you have a lot of money, it doesn't matter. For people with average income, a good rule of thumb is taking ![]() 10-20% tina panghasilan pos-pajeg anjeun per bulan

10-20% tina panghasilan pos-pajeg anjeun per bulan![]() pikeun investasi. Upami anjeun kéngingkeun $4000 per bulan, anjeun tiasa nimba $400 dugi ka $800 pikeun investasi anjeun.

pikeun investasi. Upami anjeun kéngingkeun $4000 per bulan, anjeun tiasa nimba $400 dugi ka $800 pikeun investasi anjeun.

![]() Salaku conto, investasi dina saham sareng dividen tiasa janten awal anu saé pikeun kauntungan jangka panjang kalayan anggaran terbatas. Tapi sabaraha duit anjeun tiasa nempatkeun dina investasi kudu minuhan salah sahiji sarat dasar: anjeun teu boga jumlah signifikan hutang, anjeun boga tabungan anjeun keur kaayaan darurat Anjeun, tur éta duit cadang, anjeun boga pangaweruh dasar ngeunaan investasi, tur anjeun siap nyandak resiko.

Salaku conto, investasi dina saham sareng dividen tiasa janten awal anu saé pikeun kauntungan jangka panjang kalayan anggaran terbatas. Tapi sabaraha duit anjeun tiasa nempatkeun dina investasi kudu minuhan salah sahiji sarat dasar: anjeun teu boga jumlah signifikan hutang, anjeun boga tabungan anjeun keur kaayaan darurat Anjeun, tur éta duit cadang, anjeun boga pangaweruh dasar ngeunaan investasi, tur anjeun siap nyandak resiko.

Sabaraha anu anjeun peryogikeun pikeun ngamimitian investasi?

Sabaraha anu anjeun peryogikeun pikeun ngamimitian investasi? Kumaha Mimitian Usaha Tanpa Duit?

Kumaha Mimitian Usaha Tanpa Duit?

![]() What if you don't have money? Here is the thing, you can

What if you don't have money? Here is the thing, you can ![]() ngamimitian usaha tanpa duit

ngamimitian usaha tanpa duit ![]() dumasar kana kaahlian jeung sumber sadia. Salaku conto, pamasaran afiliasi populer ayeuna. Anjeun gaduh blog anjeun, IG, Facebook, akun twitter X sareng sajumlah ageung pamiarsa sareng pengikut, éta tiasa janten tempat anu saé pikeun nempatkeun tautan afiliasi sareng kéngingkeun artos tina éta tanpa modal upfront. Pasangan anjeun bakal mayar sajumlah komisi pikeun anjeun, tiasa rupa-rupa, $1, $10, sareng seueur deui pikeun unggal pameseran tiasa waé. Sora hébat, katuhu?

dumasar kana kaahlian jeung sumber sadia. Salaku conto, pamasaran afiliasi populer ayeuna. Anjeun gaduh blog anjeun, IG, Facebook, akun twitter X sareng sajumlah ageung pamiarsa sareng pengikut, éta tiasa janten tempat anu saé pikeun nempatkeun tautan afiliasi sareng kéngingkeun artos tina éta tanpa modal upfront. Pasangan anjeun bakal mayar sajumlah komisi pikeun anjeun, tiasa rupa-rupa, $1, $10, sareng seueur deui pikeun unggal pameseran tiasa waé. Sora hébat, katuhu?

Kumaha Mimitian Investasi di Pasar Saham?

Kumaha Mimitian Investasi di Pasar Saham?

![]() Investasi di Pasar Saham

Investasi di Pasar Saham![]() is not something new. Open a brokerage account and track the movement of stock and market trends is crazily easy with your mobile phone. Anything is online. The important thing is which brokerage supplier or dealer is the best, with low or even zero transaction fees. More importantly, how you know these stocks is good to invest in. In stock, higher risk, higher rewards. If you don't like to take risks, focuses on fixed-income assets, dividends, and ETFs of S&P 500, which are well-known companies with stable growth

is not something new. Open a brokerage account and track the movement of stock and market trends is crazily easy with your mobile phone. Anything is online. The important thing is which brokerage supplier or dealer is the best, with low or even zero transaction fees. More importantly, how you know these stocks is good to invest in. In stock, higher risk, higher rewards. If you don't like to take risks, focuses on fixed-income assets, dividends, and ETFs of S&P 500, which are well-known companies with stable growth

![]() Dagang vs Investasi Mana Anu Langkung Saé?

Dagang vs Investasi Mana Anu Langkung Saé?![]() Dina pasar saham, aya dua aspék anu anjeun kedah perhatikeun,

Dina pasar saham, aya dua aspék anu anjeun kedah perhatikeun, ![]() dagang vs investasi

dagang vs investasi![]() . Patarosan umum nyaéta mana anu langkung saé. jawaban gumantung. Dagang téh ngeunaan gain jangka pondok mun anjeun meuli jeung ngajual jaminan gancang, earn ti fluctuations harga. Sabalikna, Investasi nyaéta ngeunaan kauntungan jangka panjang, nalika anjeun mésér sareng nahan saham salami mangtaun-taun, bahkan dugi ka puluhan taun pikeun mulang. Ieu mangrupikeun pilihan anjeun pikeun mutuskeun gaya investasi anu anjeun pikahoyong atanapi cocog sareng tujuan kauangan anjeun.

. Patarosan umum nyaéta mana anu langkung saé. jawaban gumantung. Dagang téh ngeunaan gain jangka pondok mun anjeun meuli jeung ngajual jaminan gancang, earn ti fluctuations harga. Sabalikna, Investasi nyaéta ngeunaan kauntungan jangka panjang, nalika anjeun mésér sareng nahan saham salami mangtaun-taun, bahkan dugi ka puluhan taun pikeun mulang. Ieu mangrupikeun pilihan anjeun pikeun mutuskeun gaya investasi anu anjeun pikahoyong atanapi cocog sareng tujuan kauangan anjeun.

Kumaha Mimitian Investasi dina Perumahan?

Kumaha Mimitian Investasi dina Perumahan?

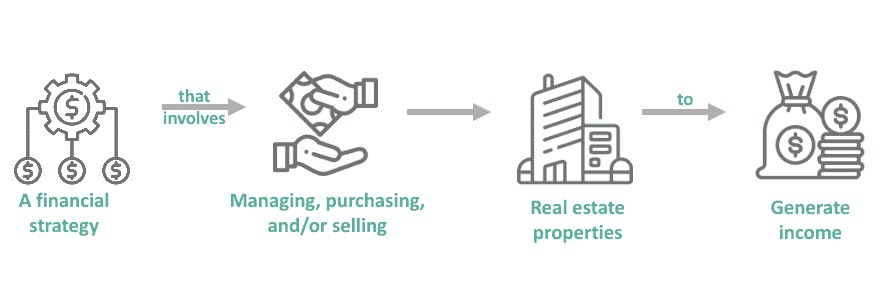

![]() Real Estate sok pasar nguntungkeun pikeun investor tapi ogé ngawengku loba resiko. Gancang ngajual aset real estate sareng kéngingkeun komisi anu luhur nyaéta anu dipikiran ku seueur jalma ngeunaan industri ieu. Tapi éta

Real Estate sok pasar nguntungkeun pikeun investor tapi ogé ngawengku loba resiko. Gancang ngajual aset real estate sareng kéngingkeun komisi anu luhur nyaéta anu dipikiran ku seueur jalma ngeunaan industri ieu. Tapi éta ![]() Perumahan Perumahan

Perumahan Perumahan![]() jauh leuwih lega ti éta.

jauh leuwih lega ti éta.

![]() Aya loba cara pikeun nyieun duit tina investasi di real estate, kayaning apresiasi, panghasilan rental, flipping sipat, Real Estate Investment Trusts (REITs), crowdfunding, real estate komérsial, pilihan ngajakan, wholesaling, sareng nu sanesna. Upami anjeun pamula dina widang ieu, perhatikeun inpormasi anu anjeun pikahoyong tina internét sareng agén, éta henteu salawasna leres sareng kamungkinan dibobodo tinggi, janten pastikeun anjeun gaduh pangaweruh anu cekap sareng ngalakukeun panalungtikan sateuacanna.

Aya loba cara pikeun nyieun duit tina investasi di real estate, kayaning apresiasi, panghasilan rental, flipping sipat, Real Estate Investment Trusts (REITs), crowdfunding, real estate komérsial, pilihan ngajakan, wholesaling, sareng nu sanesna. Upami anjeun pamula dina widang ieu, perhatikeun inpormasi anu anjeun pikahoyong tina internét sareng agén, éta henteu salawasna leres sareng kamungkinan dibobodo tinggi, janten pastikeun anjeun gaduh pangaweruh anu cekap sareng ngalakukeun panalungtikan sateuacanna.

Kumaha ngamimitian investasi di real estate pikeun beginners

Kumaha ngamimitian investasi di real estate pikeun beginners Kumaha Mimitian Investasi di SIP?

Kumaha Mimitian Investasi di SIP?

![]() Henteu kunanaon upami anjeun henteu wawuh sareng konsép SIP, sabab éta langkung populer di India kalayan kamekaran anu signifikan dina taun-taun ayeuna. SIP nangtung pikeun

Henteu kunanaon upami anjeun henteu wawuh sareng konsép SIP, sabab éta langkung populer di India kalayan kamekaran anu signifikan dina taun-taun ayeuna. SIP nangtung pikeun ![]() Rencana investasi sistematis

Rencana investasi sistematis![]() , a method of investing in mutual fund schemes, allowing investors to start investing with relatively small amounts of money regularly over time. It is a great choice for those who don't have enough money for a one-time investment. For example, after 12 months of consistently investing ₹1,000 per month with a 10% annual return, the total investment value would be approximately ₹13,001.39.

, a method of investing in mutual fund schemes, allowing investors to start investing with relatively small amounts of money regularly over time. It is a great choice for those who don't have enough money for a one-time investment. For example, after 12 months of consistently investing ₹1,000 per month with a 10% annual return, the total investment value would be approximately ₹13,001.39.

Kumaha Mimitian Investasi di Startups?

Kumaha Mimitian Investasi di Startups?

![]() How about investing in startups? Indeed it is a very risky business. According to the latest survey, the failure rate for new startups is currently 90%, 10% of new businesses don’t survive the first year. It means for each 10 startups, there is only one success. But it doesn't make people feel less faith in startups investment. Because one succeeds, it is worth billions of dollars, Apple, Microsoft, TikTok, SpaceX, Stripe,

How about investing in startups? Indeed it is a very risky business. According to the latest survey, the failure rate for new startups is currently 90%, 10% of new businesses don’t survive the first year. It means for each 10 startups, there is only one success. But it doesn't make people feel less faith in startups investment. Because one succeeds, it is worth billions of dollars, Apple, Microsoft, TikTok, SpaceX, Stripe, ![]() AhaSlides

AhaSlides![]() , and more are excellent examples. When investing in startups, remember what Warren Buffett said: "Price is what you pay. Value is what you get",

, and more are excellent examples. When investing in startups, remember what Warren Buffett said: "Price is what you pay. Value is what you get",

Takeaways Key

Takeaways Key

![]() "Don't invest in something you don't understand", said Warren Buffett. When investing, never impulsively put your money on a business without learning about it in advance. How to start investing in the digital era begins with digging for information and insight, learning from experts, and following an entrepreneur mindset.

"Don't invest in something you don't understand", said Warren Buffett. When investing, never impulsively put your money on a business without learning about it in advance. How to start investing in the digital era begins with digging for information and insight, learning from experts, and following an entrepreneur mindset.

![]() 💡Kumaha cara ngamimitian investasi dina alat presentasi? Urang sadayana peryogi presentasi pikeun diajar, ngajar, damel, sareng rapat. Geus waktuna pikeun nengetan mangpaat ningkatkeun presentasi anjeun kalawan elemen interaktif tur kolaborasi. Ngajalajah

💡Kumaha cara ngamimitian investasi dina alat presentasi? Urang sadayana peryogi presentasi pikeun diajar, ngajar, damel, sareng rapat. Geus waktuna pikeun nengetan mangpaat ningkatkeun presentasi anjeun kalawan elemen interaktif tur kolaborasi. Ngajalajah ![]() AhaSlides

AhaSlides![]() kumaha carana diajar ngeunaan presentasi ngalakonan anu néwak jutaan hate panongton.

kumaha carana diajar ngeunaan presentasi ngalakonan anu néwak jutaan hate panongton.

Patarosan remen tanya

Patarosan remen tanya

![]() Kumaha pemula kedah ngamimitian investasi?

Kumaha pemula kedah ngamimitian investasi?

![]() Ieu mangrupikeun pituduh 7 léngkah pikeun ngamimitian investasi:

Ieu mangrupikeun pituduh 7 léngkah pikeun ngamimitian investasi:

Baca ngeunaan tren pasar

Baca ngeunaan tren pasar Setel tujuan investasi anjeun

Setel tujuan investasi anjeun Mutuskeun sabaraha anjeun tiasa investasi

Mutuskeun sabaraha anjeun tiasa investasi Buka rekening investasi

Buka rekening investasi Mertimbangkeun strategi investasi

Mertimbangkeun strategi investasi Pilih bisnis investasi anjeun

Pilih bisnis investasi anjeun Lacak kinerja investasi anjeun

Lacak kinerja investasi anjeun

![]() Naha $100 cekap pikeun ngamimitian investasi?

Naha $100 cekap pikeun ngamimitian investasi?

![]() Leres, henteu kunanaon pikeun ngamimitian investasi kalayan sakedik artos. $100 mangrupikeun jumlah awal anu saé, tapi anjeun kedah teras-terasan nambihan deui pikeun ngembangkeun investasi anjeun.

Leres, henteu kunanaon pikeun ngamimitian investasi kalayan sakedik artos. $100 mangrupikeun jumlah awal anu saé, tapi anjeun kedah teras-terasan nambihan deui pikeun ngembangkeun investasi anjeun.

![]() Kumaha kuring ngamimitian investasi nalika kuring bangkrut?

Kumaha kuring ngamimitian investasi nalika kuring bangkrut?

![]() Aya seueur cara pikeun investasi upami anjeun aya di handapeun kahirupan anjeun. Kéngingkeun padamelan, laksanakeun padamelan sisi, nyéépkeun artos pikeun investasi saham tanpa seueur artos, sapertos mésér saham saham sareng ETF. Éta kauntungan jangka panjang.

Aya seueur cara pikeun investasi upami anjeun aya di handapeun kahirupan anjeun. Kéngingkeun padamelan, laksanakeun padamelan sisi, nyéépkeun artos pikeun investasi saham tanpa seueur artos, sapertos mésér saham saham sareng ETF. Éta kauntungan jangka panjang.

![]() Ruj:

Ruj: ![]() Forbes |

Forbes | ![]() Investopedia |

Investopedia | ![]() HBr

HBr