![]() How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

![]() If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc Tabl Cynnwys:

Tabl Cynnwys:

Deall Hanfodion Buddsoddiad yn y Farchnad Stoc

Deall Hanfodion Buddsoddiad yn y Farchnad Stoc Pwysigrwydd Gosod Nodau Ariannol

Pwysigrwydd Gosod Nodau Ariannol Dewis y Strategaeth Buddsoddi Cywir ac Enghreifftiau

Dewis y Strategaeth Buddsoddi Cywir ac Enghreifftiau Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc Siop Cludfwyd Allweddol

Siop Cludfwyd Allweddol Cwestiynau Cyffredin

Cwestiynau Cyffredin

Deall Hanfodion Buddsoddiad yn y Farchnad Stoc

Deall Hanfodion Buddsoddiad yn y Farchnad Stoc

![]() How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like

How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like ![]() ymddeol

ymddeol![]() neu addysg. Meddyliwch amdani fel gardd lle gall eich arian dyfu'n gyflymach na phe baech chi'n ei gadw mewn man cynilo rheolaidd.

neu addysg. Meddyliwch amdani fel gardd lle gall eich arian dyfu'n gyflymach na phe baech chi'n ei gadw mewn man cynilo rheolaidd.

![]() Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

![]() Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you

Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you ![]() gosod nodau

gosod nodau![]() , decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

, decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

Pwysigrwydd Gosod Nodau Ariannol

Pwysigrwydd Gosod Nodau Ariannol

![]() Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc Diffinio Nodau Ariannol

Diffinio Nodau Ariannol

![]() At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to

At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to ![]() mesur eich cynnydd

mesur eich cynnydd![]() a llwyddiant ar hyd y ffordd.

a llwyddiant ar hyd y ffordd.

Deall Goddefiad Risg

Deall Goddefiad Risg

![]() Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

![]() Er enghraifft, yn aml mae gan fuddsoddwyr iau oddefiant risg uwch oherwydd bod ganddynt fwy o amser i adennill ar ôl dirywiad yn y farchnad.

Er enghraifft, yn aml mae gan fuddsoddwyr iau oddefiant risg uwch oherwydd bod ganddynt fwy o amser i adennill ar ôl dirywiad yn y farchnad.

Taro Cydbwysedd ar gyfer Llwyddiant

Taro Cydbwysedd ar gyfer Llwyddiant

![]() Wrth i chi gychwyn ar eich taith fuddsoddi, mae cael y cydbwysedd cywir rhwng risg a gwobr yn hollbwysig. Mae buddsoddiadau enillion uwch fel arfer yn dod â risg uwch, tra bod opsiynau mwy ceidwadol yn cynnig sefydlogrwydd ond enillion is.

Wrth i chi gychwyn ar eich taith fuddsoddi, mae cael y cydbwysedd cywir rhwng risg a gwobr yn hollbwysig. Mae buddsoddiadau enillion uwch fel arfer yn dod â risg uwch, tra bod opsiynau mwy ceidwadol yn cynnig sefydlogrwydd ond enillion is.

![]() Mae dod o hyd i'r cydbwysedd cywir sy'n cyd-fynd â'ch nodau ariannol a'ch lefel cysur yn allweddol i ddatblygu strategaeth fuddsoddi lwyddiannus a chynaliadwy. Mae deall a diffinio'ch nodau, asesu goddefgarwch risg, a tharo'r cydbwysedd cywir yn gydrannau sylfaenol ar gyfer

Mae dod o hyd i'r cydbwysedd cywir sy'n cyd-fynd â'ch nodau ariannol a'ch lefel cysur yn allweddol i ddatblygu strategaeth fuddsoddi lwyddiannus a chynaliadwy. Mae deall a diffinio'ch nodau, asesu goddefgarwch risg, a tharo'r cydbwysedd cywir yn gydrannau sylfaenol ar gyfer ![]() llwyddiant tymor hir.

llwyddiant tymor hir.

Dewis y Strategaeth Buddsoddi Cywir ac Enghreifftiau

Dewis y Strategaeth Buddsoddi Cywir ac Enghreifftiau

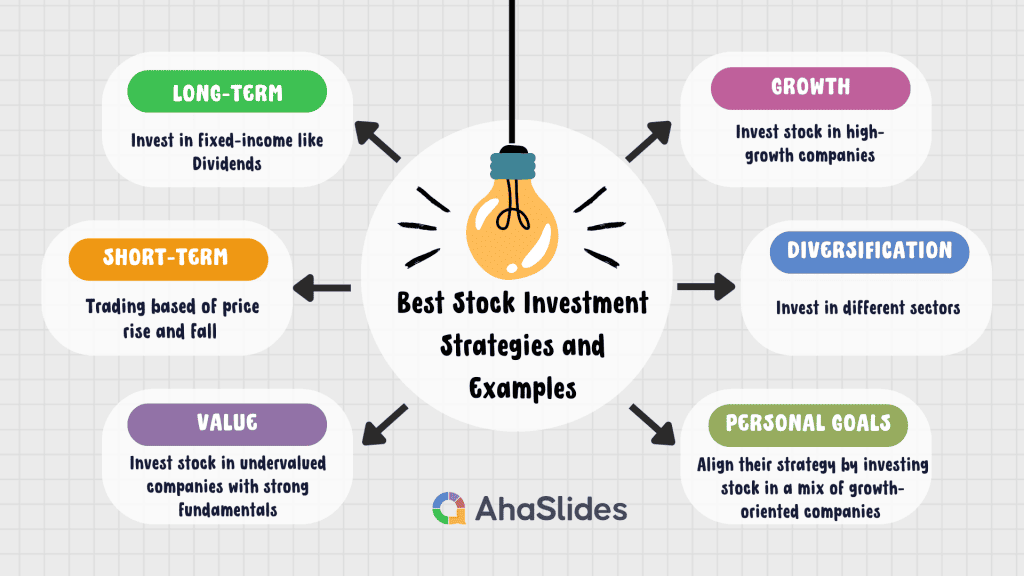

![]() Strategaethau buddsoddi yw'r glasbrintiau sy'n arwain eich penderfyniadau yn y farchnad stoc. Maent yn helpu i alinio'ch buddsoddiadau â'ch nodau ariannol a'ch goddefgarwch risg.

Strategaethau buddsoddi yw'r glasbrintiau sy'n arwain eich penderfyniadau yn y farchnad stoc. Maent yn helpu i alinio'ch buddsoddiadau â'ch nodau ariannol a'ch goddefgarwch risg.

![]() Trwy archwilio'r enghreifftiau hyn o'r byd go iawn, gall buddsoddwyr gael mewnwelediad ymarferol i sut

Trwy archwilio'r enghreifftiau hyn o'r byd go iawn, gall buddsoddwyr gael mewnwelediad ymarferol i sut ![]() strategaethau gwahanol

strategaethau gwahanol![]() gellir eu cymhwyso pan fyddant yn penderfynu buddsoddi stoc yn nhirwedd deinamig y farchnad stoc.

gellir eu cymhwyso pan fyddant yn penderfynu buddsoddi stoc yn nhirwedd deinamig y farchnad stoc.

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc Strategaethau Tymor Hir yn erbyn Strategaethau Tymor Byr

Strategaethau Tymor Hir yn erbyn Strategaethau Tymor Byr

Strategaeth Tymor Hir

Strategaeth Tymor Hir : Ystyriwch y strategaeth o unigolion sy'n dewis buddsoddi stoc mewn cwmnïau dibynadwy sy'n talu difidend fel Johnson & Johnson. Trwy gadw'r stociau hyn am gyfnod estynedig, mae buddsoddwyr yn anelu at elwa o arbrisiad cyfalaf a ffrwd incwm cyson.

: Ystyriwch y strategaeth o unigolion sy'n dewis buddsoddi stoc mewn cwmnïau dibynadwy sy'n talu difidend fel Johnson & Johnson. Trwy gadw'r stociau hyn am gyfnod estynedig, mae buddsoddwyr yn anelu at elwa o arbrisiad cyfalaf a ffrwd incwm cyson. Strategaeth Tymor Byr

Strategaeth Tymor Byr : Ar yr ochr fflip, mae rhai buddsoddwyr yn dewis buddsoddi stoc mewn sectorau cyfnewidiol fel

: Ar yr ochr fflip, mae rhai buddsoddwyr yn dewis buddsoddi stoc mewn sectorau cyfnewidiol fel  technoleg

technoleg , gan fanteisio ar dueddiadau'r farchnad tymor byr. Er enghraifft, cyfranddaliadau masnachu o gwmnïau technoleg twf uchel yn seiliedig ar chwarterol

, gan fanteisio ar dueddiadau'r farchnad tymor byr. Er enghraifft, cyfranddaliadau masnachu o gwmnïau technoleg twf uchel yn seiliedig ar chwarterol  adroddiadau perfformiad.

adroddiadau perfformiad.

Buddsoddiad Gwerth a Thwf

Buddsoddiad Gwerth a Thwf

Buddsoddi Gwerth

Buddsoddi Gwerth : Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential.

: Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential. Buddsoddi Twf

Buddsoddi Twf : Mewn cyferbyniad, gall buddsoddwyr twf ddewis buddsoddi stoc ynddo

: Mewn cyferbyniad, gall buddsoddwyr twf ddewis buddsoddi stoc ynddo  cwmnïau twf uchel

cwmnïau twf uchel like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

Arallgyfeirio

Arallgyfeirio

![]() Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps

Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps ![]() lliniaru risg

lliniaru risg![]() , ensuring that the performance of one stock doesn't overly impact the entire portfolio.

, ensuring that the performance of one stock doesn't overly impact the entire portfolio.

Cysoni Strategaeth â Nodau Personol

Cysoni Strategaeth â Nodau Personol

![]() Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

![]() Sut i ddechrau buddsoddi yn y farchnad stoc ar gyfer dechreuwyr? Trwy gyfuno dewis brocer stoc dibynadwy neu lwyfan buddsoddi gyda strategaethau monitro ac addasu parhaus, rydych chi'n creu dull cynhwysfawr o fuddsoddi stoc sy'n cyd-fynd â'ch nodau ariannol ac yn addasadwy i amodau newidiol y farchnad.

Sut i ddechrau buddsoddi yn y farchnad stoc ar gyfer dechreuwyr? Trwy gyfuno dewis brocer stoc dibynadwy neu lwyfan buddsoddi gyda strategaethau monitro ac addasu parhaus, rydych chi'n creu dull cynhwysfawr o fuddsoddi stoc sy'n cyd-fynd â'ch nodau ariannol ac yn addasadwy i amodau newidiol y farchnad.

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc  i Ddechreuwyr

i Ddechreuwyr Dewis Brocer Stoc Dibynadwy

Dewis Brocer Stoc Dibynadwy

![]() How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive

How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive ![]() addysgol

addysgol![]() adnoddau. Cyn gwneud penderfyniad, gwerthuswch ffactorau megis costau trafodion, ffioedd cyfrif, a'r ystod o opsiynau buddsoddi a gynigir.

adnoddau. Cyn gwneud penderfyniad, gwerthuswch ffactorau megis costau trafodion, ffioedd cyfrif, a'r ystod o opsiynau buddsoddi a gynigir.

Ymchwilio a Dewis Stociau

Ymchwilio a Dewis Stociau

![]() How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

Monitro Eich Portffolio Buddsoddi

Monitro Eich Portffolio Buddsoddi

![]() How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

Addasu Eich Portffolio yn ôl yr Angen

Addasu Eich Portffolio yn ôl yr Angen

![]() Sut i Ddechrau Buddsoddi yn y Farchnad Stoc Cam 4: Mae amodau'r farchnad ac amgylchiadau personol yn esblygu, sy'n gofyn am addasiadau cyfnodol i'ch portffolio. Os yw stoc yn tanberfformio neu os bydd eich nodau ariannol yn newid, byddwch yn barod i addasu eich buddsoddiadau stoc. Ystyriwch ail-gydbwyso eich portffolio neu ailddyrannu asedau i sicrhau eu bod yn cyd-fynd â'ch amcanion presennol.

Sut i Ddechrau Buddsoddi yn y Farchnad Stoc Cam 4: Mae amodau'r farchnad ac amgylchiadau personol yn esblygu, sy'n gofyn am addasiadau cyfnodol i'ch portffolio. Os yw stoc yn tanberfformio neu os bydd eich nodau ariannol yn newid, byddwch yn barod i addasu eich buddsoddiadau stoc. Ystyriwch ail-gydbwyso eich portffolio neu ailddyrannu asedau i sicrhau eu bod yn cyd-fynd â'ch amcanion presennol.

Siop Cludfwyd Allweddol

Siop Cludfwyd Allweddol

![]() In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

![]() 💡Os ydych yn chwilio am ffyrdd arloesol o ddarparu hyfforddiant cymhellol ar sut i ddechrau buddsoddi yn y farchnad stoc,

💡Os ydych yn chwilio am ffyrdd arloesol o ddarparu hyfforddiant cymhellol ar sut i ddechrau buddsoddi yn y farchnad stoc, ![]() AhaSlides

AhaSlides![]() yn fuddsoddiad gwych. hwn

yn fuddsoddiad gwych. hwn ![]() offeryn cyflwyno rhyngweithiol

offeryn cyflwyno rhyngweithiol![]() Mae ganddo bopeth sydd ei angen arnoch i fachu cynulleidfa ar yr olwg gyntaf a gwneud unrhyw rai

Mae ganddo bopeth sydd ei angen arnoch i fachu cynulleidfa ar yr olwg gyntaf a gwneud unrhyw rai ![]() gweithdai

gweithdai![]() a hyfforddiant yn effeithiol.

a hyfforddiant yn effeithiol.

Cwestiynau Cyffredin

Cwestiynau Cyffredin

![]() Sut alla i ddechrau fy nhaith yn buddsoddi yn y farchnad stoc fel dechreuwr?

Sut alla i ddechrau fy nhaith yn buddsoddi yn y farchnad stoc fel dechreuwr?

![]() Dechreuwch trwy ddysgu hanfodion stociau, bondiau a strategaethau buddsoddi trwy adnoddau a llyfrau ar-lein cyfeillgar i ddechreuwyr. Diffiniwch eich amcanion, fel cynilo ar gyfer cartref neu ymddeoliad, i arwain eich penderfyniadau buddsoddi. Deall eich lefel cysur gydag amrywiadau yn y farchnad i deilwra eich dull buddsoddi yn unol â hynny.

Dechreuwch trwy ddysgu hanfodion stociau, bondiau a strategaethau buddsoddi trwy adnoddau a llyfrau ar-lein cyfeillgar i ddechreuwyr. Diffiniwch eich amcanion, fel cynilo ar gyfer cartref neu ymddeoliad, i arwain eich penderfyniadau buddsoddi. Deall eich lefel cysur gydag amrywiadau yn y farchnad i deilwra eich dull buddsoddi yn unol â hynny.

![]() Dechreuwch gyda swm sy'n cyd-fynd â'ch cyllideb a chynyddwch eich buddsoddiadau yn raddol dros amser.

Dechreuwch gyda swm sy'n cyd-fynd â'ch cyllideb a chynyddwch eich buddsoddiadau yn raddol dros amser.

![]() Faint o arian sy'n addas i ddechreuwr fuddsoddi yn y farchnad stoc?

Faint o arian sy'n addas i ddechreuwr fuddsoddi yn y farchnad stoc?

![]() Dechreuwch gyda swm sy'n teimlo'n gyfforddus i chi. Mae llawer o lwyfannau yn caniatáu ar gyfer buddsoddiadau bach, felly dechreuwch gyda swm sy'n cyd-fynd â'ch gallu ariannol. Yr agwedd hollbwysig yw cychwyn y daith fuddsoddi, hyd yn oed os yw’r swm cychwynnol yn gymedrol, ac yn cyfrannu’n gyson dros amser.

Dechreuwch gyda swm sy'n teimlo'n gyfforddus i chi. Mae llawer o lwyfannau yn caniatáu ar gyfer buddsoddiadau bach, felly dechreuwch gyda swm sy'n cyd-fynd â'ch gallu ariannol. Yr agwedd hollbwysig yw cychwyn y daith fuddsoddi, hyd yn oed os yw’r swm cychwynnol yn gymedrol, ac yn cyfrannu’n gyson dros amser.

![]() Sut mae cychwyn stoc gyda $100?

Sut mae cychwyn stoc gyda $100?

![]() Mae cychwyn ar eich taith marchnad stoc gyda $100 yn ymarferol ac yn ddoeth. Addysgwch eich hun ar y pethau sylfaenol, gosodwch nodau clir, a dewiswch froceriaeth ffi isel. Ystyriwch gyfrannau ffracsiynol ac ETFs ar gyfer arallgyfeirio. Dechreuwch gyda stociau o'r radd flaenaf a chyfrannu'n gyson. Ail-fuddsoddi difidendau ar gyfer twf, monitro eich buddsoddiadau, ac ymarfer amynedd. Hyd yn oed gyda swm cymedrol, mae'r dull disgybledig hwn yn gosod y sylfaen ar gyfer twf ariannol hirdymor.

Mae cychwyn ar eich taith marchnad stoc gyda $100 yn ymarferol ac yn ddoeth. Addysgwch eich hun ar y pethau sylfaenol, gosodwch nodau clir, a dewiswch froceriaeth ffi isel. Ystyriwch gyfrannau ffracsiynol ac ETFs ar gyfer arallgyfeirio. Dechreuwch gyda stociau o'r radd flaenaf a chyfrannu'n gyson. Ail-fuddsoddi difidendau ar gyfer twf, monitro eich buddsoddiadau, ac ymarfer amynedd. Hyd yn oed gyda swm cymedrol, mae'r dull disgybledig hwn yn gosod y sylfaen ar gyfer twf ariannol hirdymor.

![]() Cyf:

Cyf: ![]() Forbes |

Forbes | ![]() Investopedia

Investopedia