Getting to know your customers is crucial if you wanna spread business and boost gains.

A fire way to dig deeper is by asking solid questions at the perfect time in their journey.

This guide will break down survey question types you can hit the audience with, the best flow to word them, plus when and why to ask each one.

After reading this, you will know just what they need, when they need it - and build deeper ties all around.

Table of Contents

Survey Question Types

Below are the most common survey question types and how you can use them to craft your survey masterpiece.

✅ Also see: 65+ Effective Survey Question Samples + Free Templates

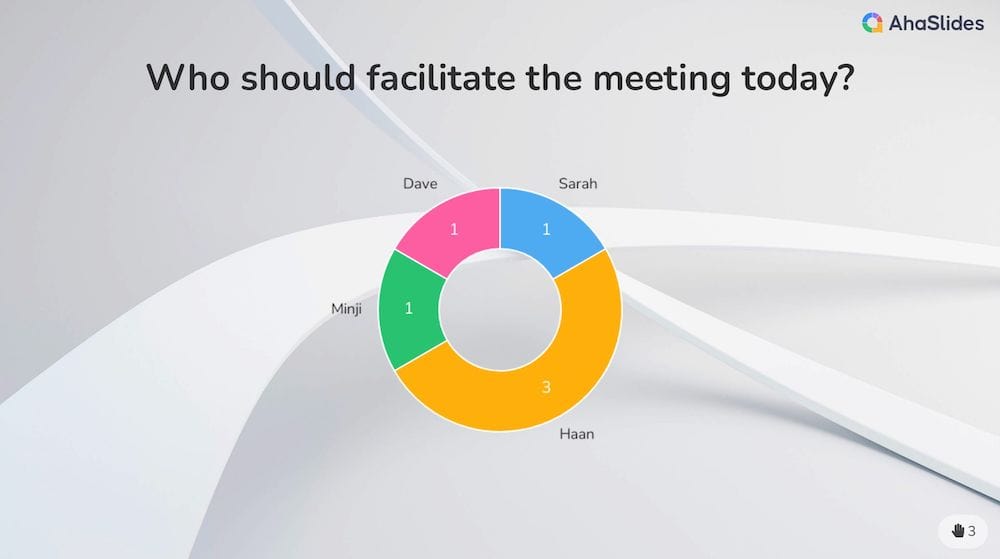

#1. Multiple choice

📌 Learn more: 10 Types of MCQ Quizzes with AhaSlides

How to use:

Options: You provide 3-5 preset answer options for the respondent to choose from. Too few limits on data, too many make it hard to choose.

Single answer: Usually only allows one selection, unless marked as able to "choose all that apply".

Ordering: The options can be randomly ordered each time to avoid bias or in a consistent order.

Required: You can set it so a selection must be made to proceed to avoid missing data.

Wording: Options should be clear, concise, and mutually exclusive so that only one fits. Avoid negative/double answers.

Visual formatting: Options may be presented horizontally in a list or bulleted vertically.

Analysis: Responses can be easily quantified as percentages/numbers for each option.

Examples: Favorite colour, income level, yes/no for policy preferences, and educational attainment are good uses.

Limitations: Doesn't allow for expansion on why that option was chosen compared to open-ended. Can miss unexpected answers.

Best for: Quickly understanding the distribution of opinions across visibly defined categories for closed questions.

#2. Matrix/Table

A matrix/table question type in surveys allows respondents to answer multiple closed-ended questions on the same topic or compare attributes side by side.

The grid-like structure of the matrix question makes visual comparisons and pattern spotting seamless for both respondents and analysts.

How to use:

Format: Looks like a grid or table with question rows and answer columns or vice versa.

Questions: Generally ask the same question about different items or compare items on the same attributes.

Answers: Keep responses consistent, like keeping the same scale across rows/columns. Commonly use rating scales, yes/no, agreement scales, etc.

Analysis: Easy to spot patterns in how respondents viewed or rated each item or attribute compared to others. Can quantify results.

Examples: Rating the importance of 5 features, comparing agreement with statements for 3 candidates, evaluating product attributes.

Benefits: Respondents can directly compare options, which minimizes bias vs separate questions. Saves time vs repetitions.

Limitations: Can get complex with many rows/columns, so keep it simple. Works best for evaluating a limited number of clearly defined items.

Best use: When directly comparing opinions, ratings or attributes is essential to understand relative preferences or evaluations rather than independent views.

#3. Likert scale

The Likert scale allows for a more nuanced measurement of attitudes compared to simple agreement questions. It captures the intensity that basic closed questions miss.

How to use:

Scale: Typically uses a 5 or 7-point ordered response scale to measure the intensity of agreement/disagreement, like "Strongly Agree" to "Strongly Disagree".

Levels: An odd number of levels (including a neutral mid-point) is best to force a positive or negative response.

Statements: Questions take the form of declarative statements that respondents rate their agreement with.

Analysis: Can determine average ratings and the percentage who agree/disagree to easily quantify opinions.

Construction: Wording must be simple, unambiguous and avoid double negatives. Scales should be properly labelled and consistently ordered.

Applicability: Used to understand the degree of sentiment toward concepts, policies, attitudes and opinions that have dimensions of intensity.

Limitations: Doesn't reveal the reasoning behind responses. More nuanced ratings can be missed vs open questions.

Examples: Rate level of job satisfaction, customer service experience, opinions on political issues or candidates' traits.

Benefits: Beyond simple agreement, provides a more detailed understanding of the intensity of feelings on topics. Easily quantifiable.

#4.Rating scale

Rating scales provide evaluative feedback in a simple, quantitative format that's easy for respondents to understand and for analysts to measure.

How to use:

Scale: Uses a numbered scale from low to high (ex: 1 to 10) to record evaluative assessments or ratings.

Questions: Ask respondents to rate something based on some defined criterion (importance, satisfaction, etc.).

Numbers: An even numbered scale (ex: 1 to 5, 1 to 10) forces a positive or negative rating vs neutral mid-point.

Analysis: Easy to determine averages, distributions, and percentiles. Can compare ratings across groups.

Benefits: Provides more nuanced data than dichotomous responses. Respondents are familiar with the scale concept.

Works well when: Asking for subjective evaluations, assessments, or prioritisations that don't require descriptive feedback.

Limitations: May still lack the context of an open-ended response. Harder to define rating criteria concretely.

Examples: Rate satisfaction with a product on a 1-10 scale. Rank the importance of 10 factors from 1 (low) to 5 (high).

Construction: Clearly define the endpoints and what each number means. Use consistent verbal and numerical labelling.

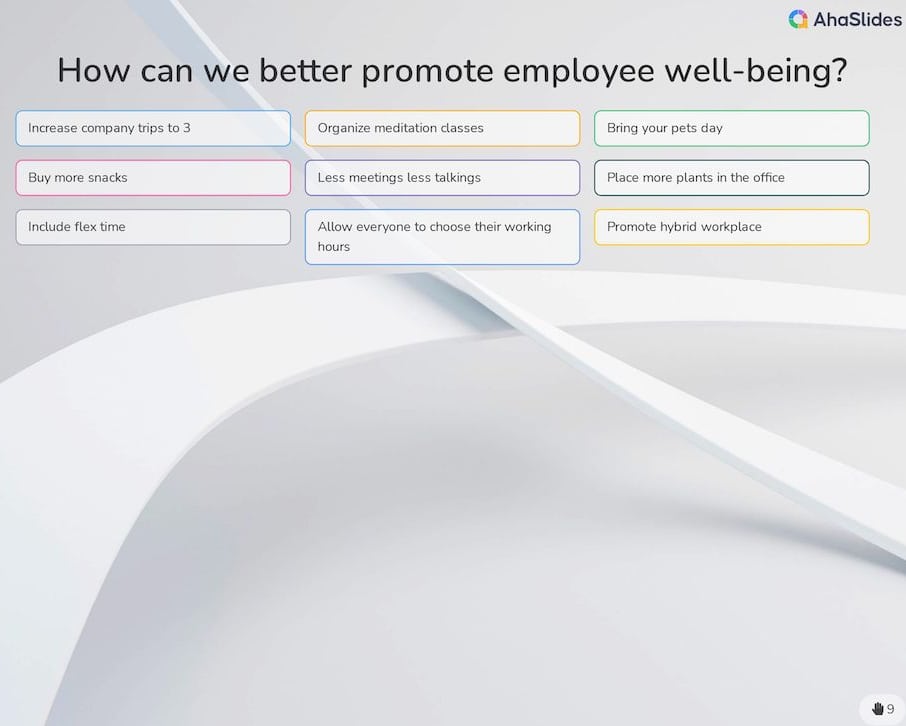

#5.Open-ended

Open-ended questions shine for gaining qualitative insights but come with increased analysis overhead versus closed-format questions.

How to use:

Format: Leaves an empty or text box for the respondent to type as much or as little as they want. No suggested answers.

Analysis: Provides qualitative rather than quantitative data. Requires more in-depth text analysis to identify themes and patterns.

Benefits: Allows for nuanced, unexpected and detailed responses outside of predefined options. Can generate new ideas or insights.

Applicability: Good for exploration, generating ideas, understanding the reasoning, and getting specific feedback or complaints in the respondent's own words.

Limitations: More difficult to quantify responses, requires more analysis effort. Response rates may be lower.

Wording: Questions should be specific enough to guide the type of information sought but without leading the response.

Examples: opinion questions, areas for improvement, explanation of ratings, solutions, and general comments.

Tips: Keep questions focused. Large text boxes encourage detail but small still allows flexibility. Consider optional vs required.

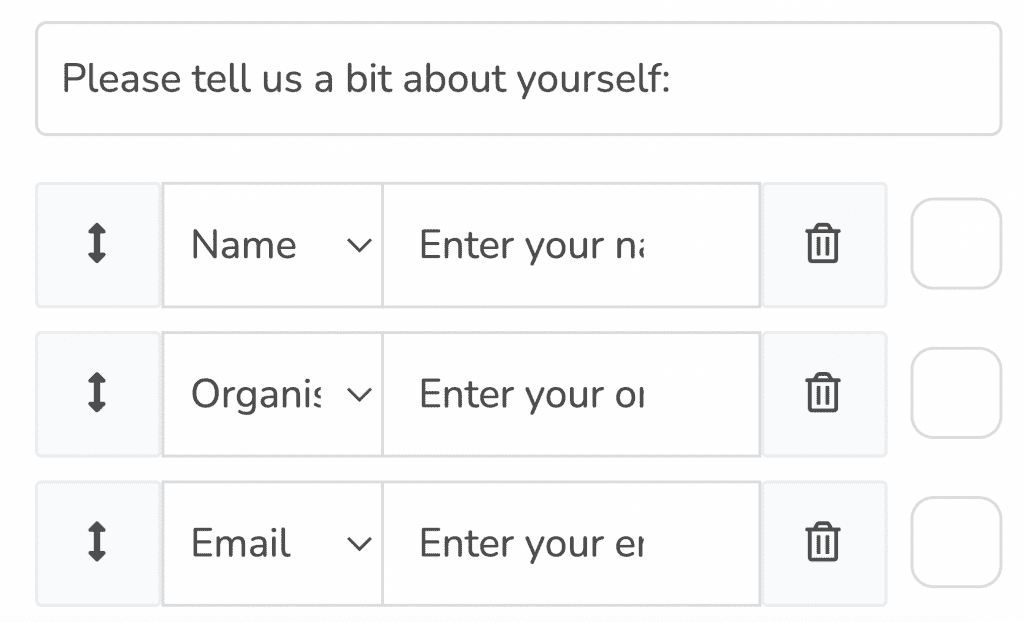

#6. Demographic

Demographic info helps analyse results from different stakeholder perspectives. Their inclusion depends on research needs and compliance considerations.

How to use:Purpose: Collect background information about respondents like age, gender, location, income level etc.

Placement: Typically included at the beginning or end so as not to bias opinion questions.

Questions: Ask objective, factual questions. Avoid subjective qualifications.

Formats: Multiple choice, dropdowns for standardised answers. Text for open fields.

Required: Often optional to increase comfort and completion rates.

Analysis: Important for segmenting responses, and spotting trends or differences between groups.

Examples: Age, gender, occupation, education level, household size, technology usage.

Benefits: Provide context for understanding variances across sample populations.

Limitations: Respondents may feel questions are too personal. Require standardised answers.

Construction: Only ask relevant questions. Clearly label any required fields. Avoid double-barreled questions.

Compliance: Follow privacy laws in what data is collected and how it's stored/reported.

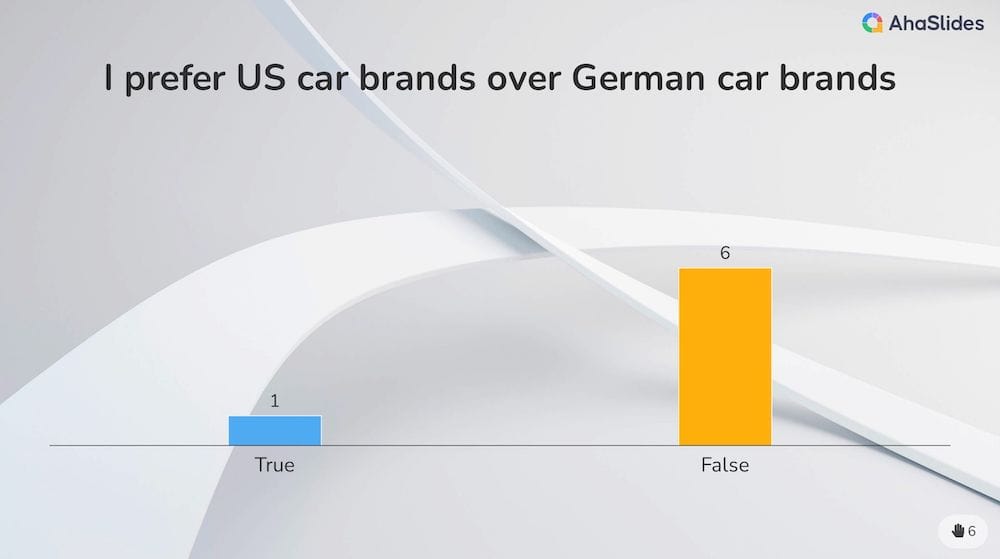

#7. True/False

True/False is best for assessing factual knowledge but lacks the context of more exploratory survey question types. Good for pre/post-testing changes.

How to use:Format: Posed as a statement where the respondent selects either True or False.

Analysis: Provides quantitative data on the percentage selecting each answer.

Statements: These should be factual, unambiguous claims that have a definitively correct answer. Avoid opinion-based statements.

Benefits: Simple binary response format is fast and easy for respondents. Good for assessing factual knowledge.

Limitations: This doesn't allow for explanation or uncertainty. Risk of guessing correct answers randomly.

Placement: Best near the beginning while knowledge is fresh. Avoid fatigue from repeating the format.

Wording: Keep statements concise and avoid double negatives. Pilot test for clarity.

Examples: Factual claims about product specs, historical events, clinical trial results, and policy details.

Construction: Clearly label the True and False response options. Consider a "Not Sure" option.

Create fire surveys with AhaSlides' ready-made survey templates!

Frequently Asked Questions

What are 5 good survey questions?

The 5 good survey questions that will elicit valuable feedback for your research are satisfaction questions, open-ended feedback, Likert scale ratings, demographic questions and promoter questions.

What should I ask for in a survey?

Tailor questions to your goals like customer retention, new product ideas, and marketing insights. Include a mix of closed/open, and qualitative/quantitative questions. And pilot test your survey first!