How to Start Investing in The Stock Market? Investing is the path for anyone to achieve their long-term financial goals. Whether you dream of a comfortable retirement, fund your child's education, or save for a big life event, investing in the stock market can be a powerful tool.

If you've ever wondered how people grow their wealth over time or how to make your money work for you, you're in the right place. In this article, we'll unravel the mysteries of the stock market and provide you with practical steps to kickstart your investment journey

Table of Contents:

- Understanding the Basics of Stock Market Investment

- The Importance of Setting Financial Goals

- Choosing the Right Investment Strategy and Examples

- How to Start Investing in The Stock Market

- Key Takeaways

- Frequently Asked Questions

Understanding the Basics of Stock Market Investment

How to start investing in the stock market for beginners? It starts with grasping the basics of stock market investment. It is like learning the ABCs of a money playground. In this place, called the stock market, people buy and sell shares, which are like tiny pieces of companies. It's not just a game for rich folks; it's a way for anyone to save money for big things like retirement or education. Think of it as a garden where your money can grow faster than if you keep it in a regular savings spot.

Now, let's talk about some important words. Market indices, like the S&P 500, are like scoreboards that show how big companies are doing. Then there are dividends, which are like little gifts some companies give you just for being their friend and owning their shares.

Plus, there's something called capital gains, which is like making extra money when you sell a share for more than you paid for it. Understanding these things is like having a treasure map—it helps you set goals, decide how much risk you're okay with, and pick the right plan for growing your money. It's like a roadmap to make you a confident explorer in the world of stock market adventures.

The Importance of Setting Financial Goals

Starting your stock market journey hinges on defining clear financial goals and understanding your risk tolerance. These goals act as your roadmap and benchmarks, while risk awareness guides your investment plan. Let's navigate the essentials of financial goals and risk understanding for long-term prosperity in the stock market.

Defining Financial Goals

At the outset of your stock market journey, it's essential to define your financial goals. Clearly outlining these objectives serves as the foundation for your investment strategy, providing not only a sense of direction but also acting as benchmarks to measure your progress and success along the way.

Understand Risk Tolerance

Understanding your risk tolerance is an important aspect of creating an investment plan tailored to your personal circumstances. The ability to accept risk is simply understood as in the worst case when the market fluctuates and you unfortunately lose all your investment money, your family's daily life will still not be affected.

For example, younger investors often have a higher risk tolerance because they have more time to recover from market downturns.

Striking a Balance for Success

As you embark on your investment journey, striking the right balance between risk and reward is paramount. Higher-return investments typically come with increased risk, while more conservative options offer stability but lower returns.

Finding the right equilibrium aligned with your financial goals and comfort level is key to developing a successful and sustainable investment strategy. Understanding and defining your goals, assessing risk tolerance, and striking the right balance are fundamental components for long-term success.

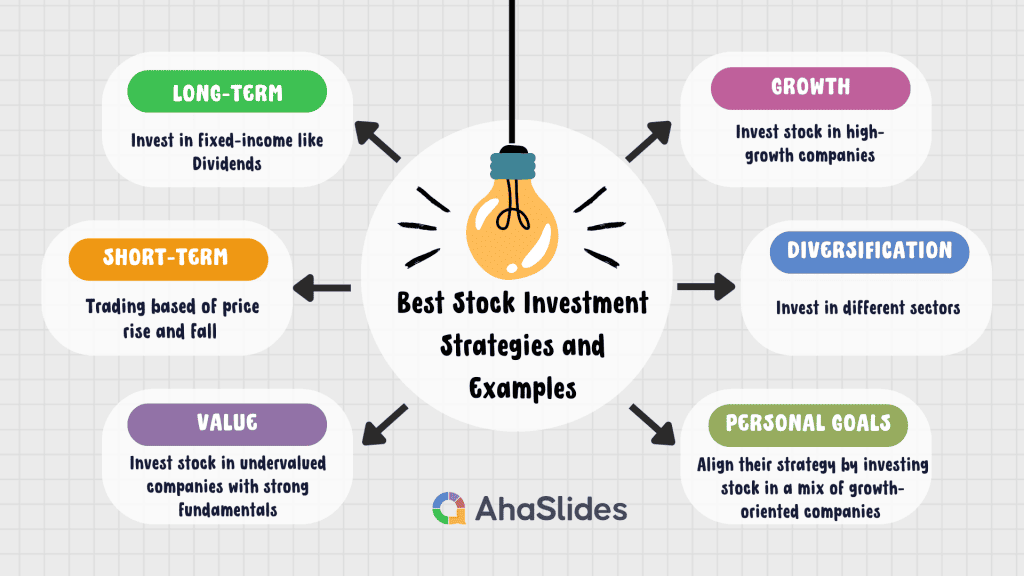

Choosing the Right Investment Strategy and Examples

Investment strategies are the blueprints that guide your decisions in the stock market. They help align your investments with your financial goals and risk tolerance.

By exploring these real-world examples, investors can gain practical insights into how different strategies can be applied when they decide to invest stock in the dynamic landscape of the stock market.

Long-Term vs. Short-Term Strategies

- Long-Term Strategy: Consider the strategy of individuals who choose to invest stock in reliable dividend-paying companies like Johnson & Johnson. By holding onto these stocks for an extended period, investors aim to benefit from both capital appreciation and a steady income stream.

- Short-Term Strategy: On the flip side, some investors opt to actively invest stock in volatile sectors like technology, capitalizing on short-term market trends. For instance, trading shares of high-growth tech companies based on quarterly performance reports.

Value and Growth Investing

- Value Investing: Iconic investors like Warren Buffett often invest stock in undervalued companies with strong fundamentals. An example could be Buffett's investment in Coca-Cola, a company that was undervalued when he first invested, but with solid growth potential.

- Growth Investing: Contrastingly, growth investors may choose to invest stock in high-growth companies like Tesla. Despite the stock's high valuation, the strategy is to benefit from the company's anticipated future growth.

Diversification

Savvy investors understand the importance of diversifying how they invest stock. They might diversify across sectors, "investing stock" in technology (e.g., Apple), healthcare (e.g., Pfizer), and energy (e.g., ExxonMobil). Diversification helps mitigate risk, ensuring that the performance of one stock doesn't overly impact the entire portfolio.

Aligning Strategy with Personal Goals

Consider an investor looking to invest in stock for their child's education fund. They might align their strategy by investing stock in a mix of growth-oriented companies like Google for potential long-term gains and stable dividend-paying stocks like Microsoft for a consistent income stream to fund educational expenses.

How to Start Investing in The Stock Market

How to start investing in the stock market for beginners? By combining the selection of a reliable stock broker or investment platform with ongoing monitoring and adjustment strategies, you create a comprehensive approach to investing stock that is aligned with your financial goals and adaptable to changing market conditions.

Choosing a Reliable Stock Broker

How to Start Investing in The Stock Market Step 1: Investing in stocks requires a solid foundation, starting with the selection of a trustworthy stock broker or investment platform. Consider well-established platforms like Robinhood or Skilling, Vanguard,... known for their user-friendly interfaces, low fees, and comprehensive educational resources. Before making a decision, evaluate factors such as transaction costs, account fees, and the range of investment options offered.

Researching and Selecting Stocks

How to Start Investing in The Stock Market Step 2: With your account set up, it's time to "invest stock." Utilize the research tools provided by your chosen platform. For example, platforms like Robinhood or Interactive Brokers offer detailed analyses, stock screeners, and real-time market data. As you navigate, keep your investment goals in mind, selecting stocks that align with your strategy, whether it's growth, value, or income-focused.

Monitoring Your Investment Portfolio

How to Start Investing in The Stock Market Step 3: Once you invest in stock, regular monitoring is crucial. Most platforms provide portfolio tracking features. For instance, Merrill Edge offers a user-friendly dashboard displaying your portfolio's performance, individual stock details, and overall asset allocation. Regularly checking these metrics keeps you informed about how your investments are performing.

Adjusting Your Portfolio as Needed

How to Start Investing in The Stock Market Step 4: Market conditions and personal circumstances evolve, requiring periodic adjustments to your portfolio. If a stock is underperforming or your financial goals change, be prepared to adjust your stock investments. Consider rebalancing your portfolio or reallocating assets to ensure they align with your current objectives.

Key Takeaways

In conclusion, investing in the stock market is not merely a financial transaction; it's a strategic endeavor toward wealth creation. By understanding the basics, setting clear goals, and selecting the right investment strategy and platform, you position yourself as a confident explorer in the vast and ever-evolving landscape of stock market opportunities.

💡If you are looking for innovative ways to deliver compelling training on how to start investing in the stock market, AhaSlides is a great investment. This interactive presentation tool has everything you need to grab an audience at first sight and make any workshops and training effective.

Frequently Asked Questions

How can I start my journey in stock market investing as a beginner?

Begin by learning the fundamentals of stocks, bonds, and investment strategies through beginner-friendly online resources and books. Define your objectives, such as saving for a home or retirement, to guide your investment decisions. Understand your comfort level with market fluctuations to tailor your investment approach accordingly.

Begin with an amount that aligns with your budget and gradually increase your investments over time.

How much money is suitable for a beginner to invest in the stock market?

Commence with an amount that feels comfortable for you. Many platforms allow for small investments, so start with an amount that fits your financial capacity. The crucial aspect is initiating the investment journey, even if the initial sum is modest, and consistently contributing over time.

How do I start a stock with $100?

Starting your stock market journey with $100 is feasible and wise. Educate yourself on the basics, set clear goals, and choose a low-fee brokerage. Consider fractional shares and ETFs for diversification. Begin with blue-chip stocks and contribute consistently. Reinvest dividends for growth, monitor your investments, and practice patience. Even with a modest sum, this disciplined approach lays the foundation for long-term financial growth.

Ref: Forbes | Investopedia